My car insurance cost blog 0671

The 4-Minute Rule for How Much Does Car Insurance Cost On Average? - The Zebra

Even though having insurance is the law in nearly every state, some people are still without protection. UM/UIM assists safeguard you if you get hit by one of them, and they do not have enough protection to pay for your expenses.

These amounts are the most an insurance coverage business will pay after an accident. Utilizing the example above, the insurance company will pay up to $10,000 for a single person's injuries and up to $20,000 for all injuries.

Each state has its own minimum protection requirements. auto insurance. Talk to the DMV to learn what they are where you live. Buying the minimum amount of liability coverage your state requires might appear like a good way to save cash. It might cost you. A state's minimum insurance requirement is hardly ever adequate to spend for injuries and automobile damage after a serious mishap.

According to Page, most people have liability limits of 100/300/50, which is much better than the state minimum.," he states. cheap car.

Or you can purchase an umbrella policy, which Page says is a much better alternative because: It increases your protection under both your house and vehicle insurance plan. It's ending up being more common for carriers to extend the coverage to your uninsured/underinsured motorist protection also. It's relatively economical. Page advises that people with a net worth of up to $10 million have insurance protection that's at least equivalent to their possessions.

Minimum levels of liability protection aren't helpful for much, but it's much better than having no insurance at all. If you don't have any assets, you might deal with little financial threat by keeping your state's minimum requirements. However if you have any assets to protect, you could be putting them at risk.

When buying car insurance, there are several elements to consider before picking coverage, including: At a bare minimum, you must have sufficient insurance coverage to drive lawfully in your state. It is necessary not to stint the coverage you need to conserve money. "However buying a policy that you can pay for is much better than purchasing a policy that will lapse since you can't afford it," states Page. cheaper car.

Some Known Incorrect Statements About Uaic - United Auto - United Automobile Insurance Company ...

Collision and comprehensive coverage are optional in every state - business insurance. But if you can't pay for to fix or replace your vehicle, these protections can be indispensable. "If you could manage to change the automobile, then you have the luxury of deciding whether you want to [spend] a couple hundred bucks a year or take the danger [of not maintaining coverage]," Page stated.

The coverages encompass the vehicle and individuals impacted by the crash however not the people in your vehicle. The majority of states need you to bring a minimum amount of liability coverage on your automobile. No one can predict precisely how much you 'd need to pay if you cause a crash.

Get a vehicle insurance coverage quote Do you require detailed and/or accident insurance coverage on an old automobile? Crash coverage covers repair work to your vehicle if you're in a mishap. Comprehensive coverage covers your automobile if it's stolen or harmed beyond an accident. You might not have not a choice to carry this protection if your cars and truck is rented or financed; most lending institutions will need you to carry enough coverage to cover the cost of repairs to your vehicle.

If your car is amounted to from an accident in which the other driver as at fault and has no insurance, struck in a parking lot while you were in the shop shopping, or stolen from while you were hiking at a park, do you have the means to replace it without any aid from the insurance coverage company? If your automobile is older, it may be time to drop the crash and extensive protection and put that money into cost savings (cheaper auto insurance).

If so, it might be time to drop the coverage. For instance, if your automobile deserves $1,000 and your coverage costs $500 a year plus a $500 deductible, you're not really getting anything for your money. How much should my crash and comprehensive deductibles be? This is a balancing act.

If you're questioning just how much car insurance coverage you require, the short response is that you require the minimum amount of vehicle insurance needed by your state to drive lawfully, but you should purchase a policy that pays: If you're not sure what that means, this is explained in detail listed below by's editorial director, Michelle Megna, and Customer Expert Cent Gusner.

Second, you need adequate cars and truck insurance to protect your life from monetary ruin if you have an automobile accident. That can be as simple as buying the minimum protection, in some cases, though rarely. Or it can be much more complex.

The smart Trick of How Much Car Insurance Do You Need? - Investopedia That Nobody is Discussing

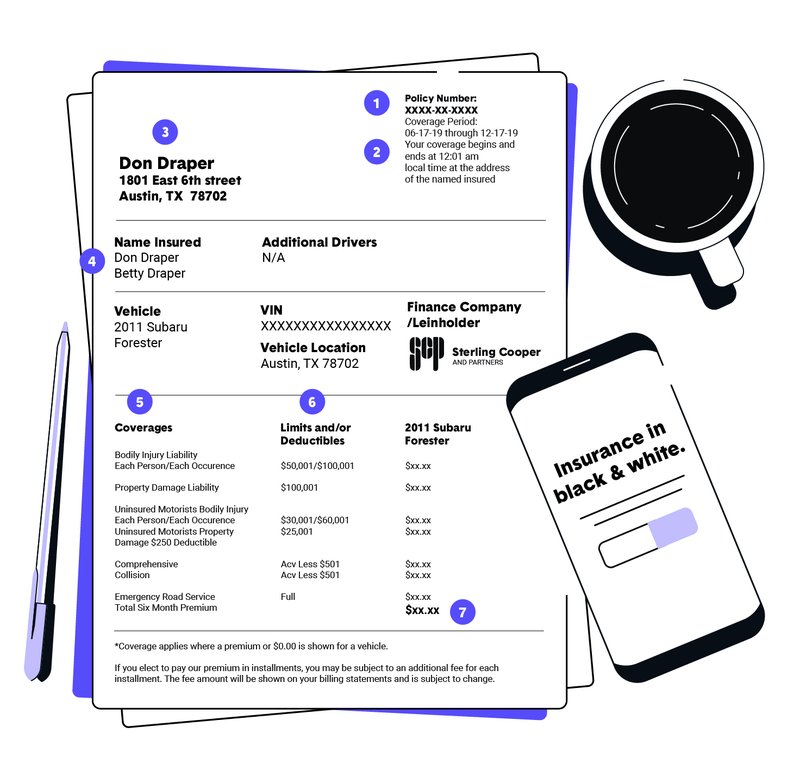

What are the kinds of cars and truck insurance coverage? There are 5 fundamental types of automobile insurance coverage coverages: liability, crash, detailed, uninsured/underinsured driver protection and medical payments. credit. Liability protection insures you against loss in case your car triggers injury or damage to other person's property. Many states need you to have liability protection to legally drive on the roadway.

This protection helps spend for repairs or replacement of damaged parts. Comprehensive insurance coverage covers damages triggered to your vehicle due to factors other than accident, such as weather, fire or theft (cheapest). Including this protection might increase the cost of your insurance premium, however it can protect you in case something unfortunate takes place to your lorry.

Accident security (PIP), is an insurance protection that pays your medical expenses - car insured. It likewise covers lost salaries and other costs for you or your guests regardless of who is at fault in the vehicle mishap. Med, Pay or Medical payments protection resembles personal injury security. It covers your medical expenditures related to injuries resulting from a mishap, regardless of who was at fault.

It pays out if you trigger injury or residential or commercial property damage in an accident with another person. If your vehicle faces problem for reasons that are not related to an accident, mechanical breakdown insurance coverage (MBI) exists to cover the expenses of getting it repaired. If you have a broken engine then MBI will pay out for the repairs. affordable auto insurance.

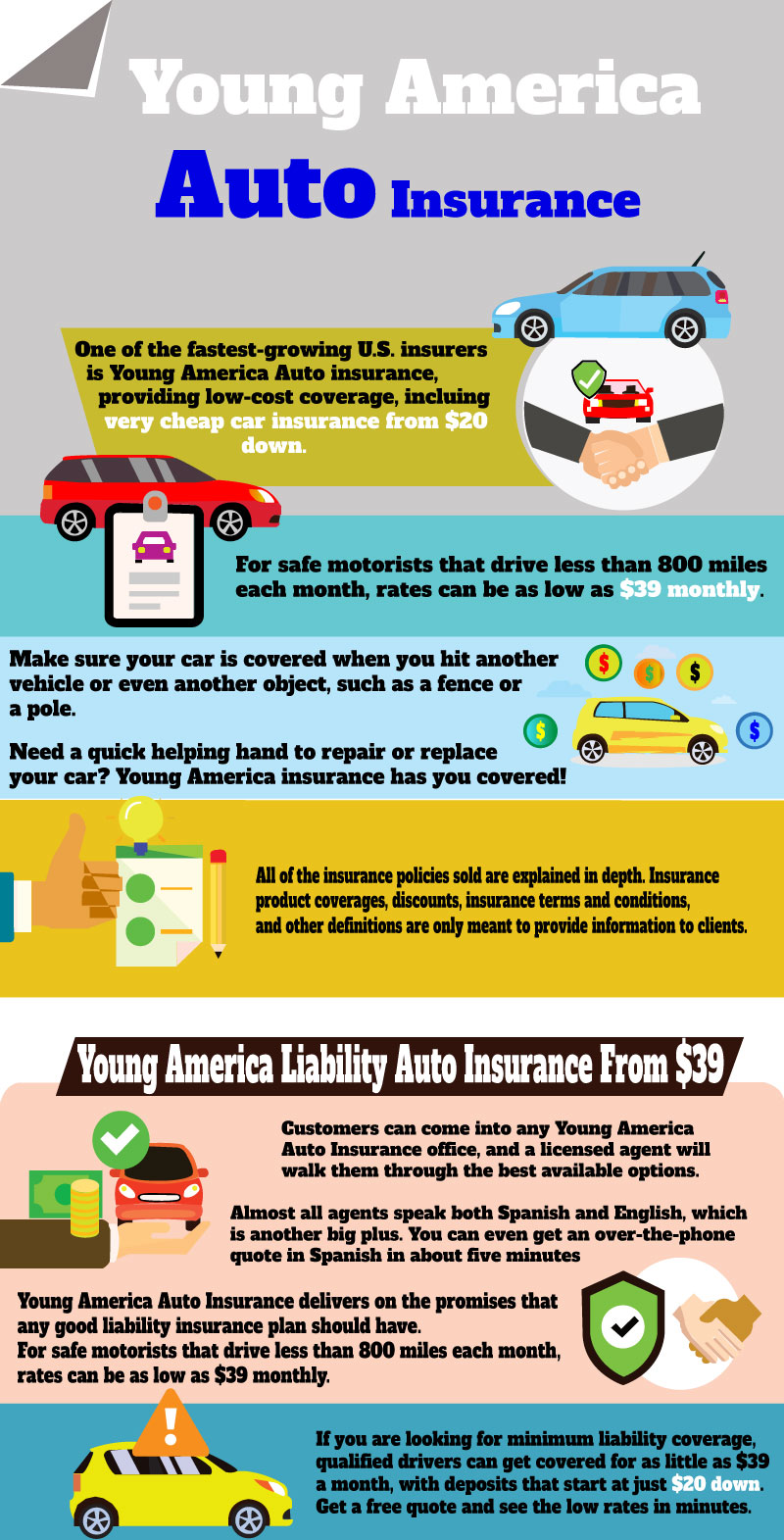

Who should buy minimum levels of liability vehicle insurance? Minimum liability is seldom advisable, but if you can't manage more, it's much better than no insurance.

If you own just the clothing on your back and an older cars and truck, you may have the ability to manage with just the minimum levels of liability mandated by your state. That's due to the fact that you're probably what is known as "judgment-proof." You may lose if someone chooses to take you to court to pay for an accident you trigger, however you have no genuine possessions to take (affordable auto insurance).

The second is the per-accident limitation. The 3rd number is the home damage liability limitation, which would repair or change the car of anybody you hit. 50/100/50This level of coverage is recommended for those who have an older vehicle, couple of properties, don't drive much and are on a tight budget-for instance, university student or retired people who are scaling down. auto insurance.

New Jersey's Basic Auto Insurance Policy - Truths

The expense of liability insurance, when you have bought the fundamental levels, does increase, however does not increase tremendously. The average rate for state minimum protection is $574. The typical rate for 50/100/50 is $644. The average rate for 100/300/100, with extensive and accident and a $500 deductible is $1,758.

Who should purchase uninsured vehicle driver cars and truck insurance coverage? If you have your own health insurance coverage and you have purchased collision protection, you may be able to avoid uninsured driver coverages if your state enables.

Your state may require that you buy uninsured motorist bodily injury protection, which pays your hospital expenses if you are struck by an uninsured chauffeur - perks. Your state might need just that you be used this protection but permit you to turn it down. If you purchase this coverage, it normally will come in the exact same amounts as your own liability protection.

Yes, if your automobile is less than 10 years old. Yes, if you can't afford to repair or change your car.

This is where car insurance for a 10-year-old vehicle comes into play. You need to likewise carry detailed and accident insurance if your car is 10 or more years older, however worth more than $3,000, or if you can't afford to repair or replace it.

Liability insurance pays just for others' cars. dui. You need to choose a deductible quantity for collision and detailed protections. Damage below this amount is your duty to repair. We advise that you keep deductibles low while you are still paying on an automobile. Once the car is settled, develop an emergency fund and raise your deductible to match it.

Yes, if you can't manage or don't have the cost savings to live without a loss of income due to injury. insurance. Your state, particularly if it is a no-fault state, may need that you purchase injury defense so that your injuries in a vehicle accident are constantly covered up to your limitations, no matter whose fault the accident was.

The Definitive Guide for How Much Car Insurance Do You Need? - Policygenius

Picking the best amount of automobile insurance can be challenging. While you're obligated to get the minimum amount of car insurance needed to drive in your state, how much you buy beyond that should depend on your own financial scenario.

If you do buy collision and detailed coverage, pay attention to the deductible how much you pay out of pocket before your insurance coverage pays out for a claim - car. Collision and comprehensive deductibles tend to vary from $250 to $1,000; pick a quantity you might manage to pay in a jam.

https://www.youtube.com/embed/g0lcv5LIIx0

Uninsured driver coverage is advised, About 1 in 8 chauffeurs on the roadway don't have car insurance coverage, according to 2019 information from the Insurance Research Council. auto insurance. If you're hit by among them, you might run out luck unless you have uninsured vehicle driver protection or underinsured vehicle driver protection in case the individual whose vehicle hits yours does not have sufficient liability insurance.

Some Known Questions About The Best Car Insurance Companies Of 2022 - Usnews.com.

Many of the ads talk about how that business has the finest cost. We developed an automobile insurance coverage calculator so you can understand what's a reasonable price. Remarkably, the cost or insurance coverage can, and does, vary considerably.

Insurance prices differs a lot by state. We developed a vehicle insurance coverage calculator for each of the 50 states.

Every insurer wants your organization, however how can you tell which to opt for for your cars and truck insurance coverage? If you wish to discover the very best automobile insurance, it may take a little research study and careful consideration. In this guide, we'll reveal you how to compare various rates and providers, go over factors that can impact your car insurance quotes, and supply a list of suggested contrast websites that will reduce the time it takes you to discover the best automobile insurance provider.

There are various ways to go about this, and each method might use differing outcomes. What secondhand to operate in the past may not be the most effective technique anymore. Here are a couple of methods you can compare automobile insurance companies and their rates: 1. Research study specific insurance coverage service providers Pulling up a specific insurance coverage company's website is normally simple to do on your phone, computer, or other gadget.

Once you have actually ended up taking a look at one supplier's website, you can move onto the next and do more research with them. It's a simple strategy and seems simple enough, but this process can be lengthy. money. To get a quote from an insurance provider, you have to input all your info and perhaps your partner's info also.

In addition, it can get complicated taking a look at different provider sites. Terms is not standardized throughout the insurance coverage industry. The terms business utilize for certain coverages may be various, even if they suggest the same thing. This can make it tough to comprehend just what is being offered by each business.

However, discovering the specific car insurance coverage that's right for you can take a while and might cost you more in time than it conserves you since you probably haven't heard of every single provider out there. 2. Go to an insurance representative Insurance representatives can be an useful resource for automobile insurance information considering that they're the experts on the topic, right? It holds true, they need to know what they're talking about, however that does not indicate you're going to have an unbiased interaction with a representative.

Rd Wood Insurance Associates, Inc. Offers A Wide Range Of ... for Dummies

It's in their best interest to do so since that's who they work for. If you satisfy with an independent insurance agent, you'll at least get a look at rates from numerous insurance business.

It's also not the most convenient to establish a conference with an agent when you're unsure if it'll deserve your time. If you want to get the facts from every company about what they offer, you 'd need to satisfy a private representative from each company or work with an independent representative.

In general, this technique might have made good sense in the past, now it seems outdated and ineffective. 3. Utilize a vehicle insurance comparison site If you wish to know how to conserve cash on car insurance coverage, use an vehicle insurance comparison website. Vehicle insurance coverage comparison sites are usually the most convenient and most comprehensive technique of comparing vehicle insurance business and rates.

You can then look at the different offers and compare them (insurance). In such a way, this is the same method as searching for private insurance provider yourself, except much quicker. You only have to fill out your info one time, and then the contrast website immediately completes the kinds on each business's site for you.

Our suggestions for the best automobile insurance coverage comparison websites Car insurance coverage comparison sites provide a basic and straightforward method to easily take a look at quotes and protections from various insurance coverage companies. If you were to go to each private insurance coverage website yourself to do research, it would take a lot more time.

Here are our suggestions for the very best automobile insurance coverage comparison sites: Estimate Wizard Quote Wizard is a straightforward contrast site that streamlines the process of comparing vehicle insurance quotes - cheap insurance. In just minutes, you could be on your way to the finest car insurance coverage rate and coverage you've ever had. There's nothing hard about Quote Wizard's procedure.

There's no cost for these services, and companies consist of State Farm, Allstate, Farmers, Progressive, and Liberty Mutual. The Zebra The Zebra offers quotes from over 100 service providers and says you can conserve approximately $670 a year by utilizing their services. For how fast they bring up rate quotes for you, that's a great deal of prospective cost savings.

The 8-Second Trick For Best Car Insurance Discounts For Teachers - Policyadvice

Provide Automobile Insurance Coverage Offer Automobile Insurance Coverage is an online insurance marketplace that connects individuals and insurance suppliers. When you've rapidly constructed your profile, Offer will discover the most relevant options for you based upon the info you offered. There's no charge to use Supply Insurance's services, and there's no pressure to choose any particular business.

When comparing quotes, it's essential you compare the exact same automobile insurance protection between various suppliers. For example, you'll wish to ensure the crash protection is for the very same quantity or has the same deductible. This is essential since one company may appear like it's providing cheap automobile insurance coverage, but if they do not provide the same protection, it's not a reasonable contrast. cheapest car insurance.

Here are the essential things to think about when you're taking a look at a car insurance plan: The quantity you pay out of pocket prior to insurance coverage kicks in. Covers you if your vehicle is in a mishap, including with another car, an item, or by itself (such as a rollover). Covers theft, vandalism, or damage to your car that isn't covered by accident insurance.

May cover rehab costs and lost salaries too. May likewise be called other things by the provider, but it normally suggests guaranteeing the distinction or some portion of the difference in between what you owe on a vehicle loan and what your automobile is really worth. Generally covers any expenses required if you break down, such as towing, battery jump-start, blowout modification, and more.

Depending on your personal choices, you might likewise want to examine any perks or advantages that come with an insurance coverage from a particular company. Some companies have great mobile apps, while others do not (cheaper). As part of your research study, be sure to look at customer insurance coverage reviews and consumer complete satisfaction rankings of any provider you're thinking about.

: Those with a good driving record may get a lower rate at-fault accidents and traffic offenses will increase your rates. The more pricey your vehicle, the higher your rates will be.

An excellent credit score will assist you get lower rates. If you drive more, your rates may be higher.

Some Known Details About 10 Best Car Insurance Companies Of 2022 - Wallethub

For the quickest and most effective way of finding the best rates, utilize a car insurance contrast site. This will take the hassle out of browsing through various insurance products and investing a lot of time to find your answers.

Rate contrasts supplied here are based on our Progressive Direct auto insurance coverage rate and item, and do not include costs and products offered from Progressive representatives. Name Your Rate is available in the majority of states for new policies. Price and protection match restricted by state law. Quantities entered beyond our variety of coverage rates will be revealed the closest readily available coverage bundle.

with insurance providers affiliated with Progressive and with unaffiliated insurance companies. Each insurance provider is entirely responsible for the claims on its policies and pays PAA for policies sold. Costs, coverages and personal privacy policies differ amongst these insurers, who might share information about you with us. PAA's payment from these insurance providers might vary in between the insurance providers and based upon the policy you buy, sales volume and/or profitability of policies offered.

attempts to price quote each candidate contacting us for a quote with a minimum of one of these insurance companies by utilizing its Entrepreneur, General Liability, Professional Liability and Workers' Compensation pricing quote standards for the applicant's state. cheaper cars. These standards will figure out the business priced quote, which may vary by state. The company priced quote might not be the one with the lowest-priced policy readily available for the applicant.

Protection based on policy terms and conditions. vehicle.

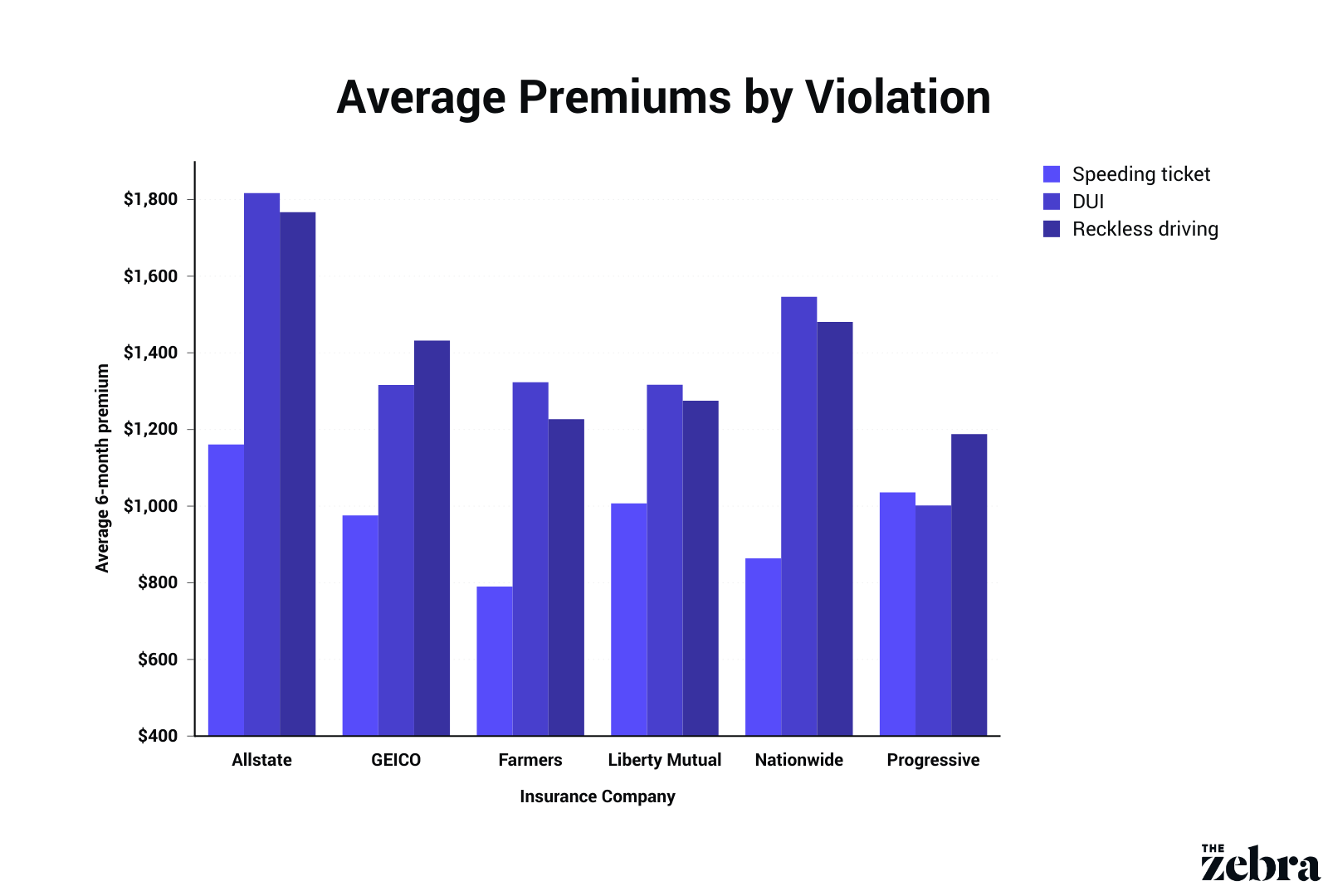

Entering into a mishap, specifically if you're at fault, will likely result in higher rates in the future. Some companies, such as Allstate and Farmers, might use accident forgiveness that avoids an accident from increasing your rates. USAA, GEICO and State Farm might use the most affordable rates if you haven't remained in an accident or have remained in one at-fault accident.

Finest Automobile Insurance Rates for Young Motorists, As anyone who's included a teen to their vehicle insurance coverage can inform you, young motorists tend to be costly to guarantee. Costs drop as you get older, and can level out when a motorist remains in their mid-20s (car insurance). If you're a young person (or somebody covered by your policy is), you may want to purchase new quotes after every birthday.

What Does The Best Car Insurance In 2022 - Benzinga Do?

Amongst the more conventional insurance coverage companies, USAA, State Farm and GEICO might provide the most affordable rates. Frequently, there will not be a big difference unless you go with a usage-based policy. Best Automobile Insurance Coverage Rates Based on Your Credit, In a lot of states, credit-based insurance coverage scores can be an aspect in identifying your automobile insurance premiums.

At a minimum, the majority of states need chauffeurs to have liability protection, which pays for others' medical costs and damage to their residential or commercial property. You may likewise have to purchase medical protection or accident security, which can assist spend for your (and your passengers') healthcare. If you want coverage in case your automobile is damaged or stolen, you'll need collision protection (for damage from accidents) and extensive protection (for theft and damage brought on by something aside from a crash, such as a storm).

Nevertheless, it's a tradeoff as more coverage and lower deductibles also cause higher premiums. How to Get the very best Rates on Your Car Insurance coverage No matter which kinds of coverage, limitations and deductibles you choose, there are a couple of ways to save money on automobile insurance: There's no insurance coverage company that uses the very best price for everyone. affordable auto insurance.

As a result, improving your credit might assist you get approved for much better rates. Some insurance coverage companies, such as Liberty Mutual, use a discount if you purchase your protection online. Progressive and Elephant Insurance even offer you a discount rate if you get a quote online and purchase the policy with an insurance coverage agent. You won't constantly find a cost savings opportunity, however the aspects that determine your rates, your insurance requires and the business' offering and choices can all alter with time.

Coverage based on policy terms and conditions. insure.

Entering into a mishap, particularly if you're at fault, will likely cause higher rates in the future. insurers. Some business, such as Allstate and Farmers, may offer mishap forgiveness that avoids an accident from increasing your rates. USAA, GEICO and State Farm may provide the most affordable rates if you have not remained in a mishap or have actually been in one at-fault mishap.

Finest Car Insurance Coverage Rates for Young Drivers, As anyone who's added a teenager to their auto insurance coverage can inform you, young motorists tend to be expensive to insure. Costs drop as you get older, and can level out once a motorist remains in their mid-20s. If you're a young person (or someone covered by your policy is), you may wish to purchase new quotes after every birthday. trucks.

Some Known Questions About Best Jobs In Car Insurance - Onrec.

Among the more standard insurance companies, USAA, State Farm and GEICO may provide the most affordable rates. But frequently, there will not be a big difference unless you go with a usage-based policy. Best Car Insurance Coverage Rates Based on Your Credit, In many states, credit-based insurance ratings can be an aspect in determining your car insurance coverage premiums - cheap insurance.

At a minimum, most states need drivers to have liability coverage, which pays for others' medical costs and damage to their property. You might likewise have to acquire medical protection or accident defense, which can help spend for your (and your passengers') medical care. If you want protection in case your automobile is harmed or taken, you'll require accident protection (for damage from accidents) and extensive coverage (for theft and damage brought on by something other than an accident, such as a storm).

It's a tradeoff as more coverage and lower deductibles also lead to greater premiums. How to Get the very best Rates on Your Automobile Insurance No matter which types of coverage, limits and deductibles you select, there are a few methods to conserve money on automobile insurance coverage: There's no insurance provider that offers the best cost for everyone.

https://www.youtube.com/embed/_-RgQa36ASc

As an outcome, improving your credit could help you receive better rates. Some insurance coverage business, such as Liberty Mutual, use a discount rate if you buy your coverage online. Progressive and Elephant Insurance even offer you a discount rate if you get a quote online and buy the policy with an insurance coverage representative - cheaper auto insurance. You won't constantly discover a savings opportunity, however the factors that determine your rates, your insurance requires and the business' offering and choices can all alter over time.

Some Known Facts About 7 Ways To Save Money On A Teen Driver's Car Insurance.

Age likewise plays a considerable function in figuring out premium increases. The typical superior increase is greatest for a 16-year-old male motorist (112 percent) and reduces each year through age 19, when premiums enhance by 70 percent, on standard - cheap car insurance. The typical premium boost for ladies is also highest at age 16, resulting in an ordinary spike of 87 percent.

" Driving well takes technique, and because all teens are brand-new motorists they make all type of mistakes that more seasoned vehicle drivers can avoid," claims Eli Lehrer, head of state of the not-for-profit R Road Institute. "Additionally, teensparticularly male teens are likely in the direction of all kind of foolish willful habits that they eventually grow out of." When again the insurance coverage, Quotes research study located that not all states are developed equivalent when it comes to the cost of insuring a teen chauffeur (credit score).

In Hawaii, however, the typical increase is just 12 percent. Right here are the 5 most costly states for vehicle insurance policy, generally, for adding a teenager vehicle driver to a present vehicle plan: On the other hand, right here are the five least expensive states, typically, for adding a teen driver to an existing automobile plan: As always, the factors behind these distinctions are somewhat complicated as well as hard to select, but it begins with the reality that each state regulates insurance policy in a different way, as well as those regulative distinctions make up several of the variations in the study's findings.

That indicates teens actually do not pay much more than grownups for auto insurance coverage. This might additionally represent lower increases in states like Michigan and North Carolina, where insurance policy is controlled even more stringently and also ranking aspects are stricter, which indicates it's harder for private insurance providers to raise as well as lower premiums - cheap car insurance.

To that end, Lehrer includes: "Everyone knows that young adults are bad drivers. No matter of the expense sustained by guaranteeing a teenager motorist, security remains the key concern for moms and dads.

The Ultimate Guide To Insurance For Teen Drivers: Q & A

" The most effective means to guarantee your teenager will certainly be a safe driver is by establishing safe behaviors and teaching by example," says Smith. "Prevent speeding as well as damaging any kind of minor driving regulations. By putting your ideal foot onward, your teen can hopefully mimic your secure practices.". Ken Hayes, author of Drive Me To Think, says moms and dads need to make a note of a list of driving dedications that their teenager must read as well as sign.

" This method aids concentrate the mind on their dedications and when those dedications are of a higher nature, they are far more likely to be stuck to." Otherwise called usage-based insurance (UBI), pay-as-you-drive programs are currently provided by a few of the county's largest insurance service providers, consisting of Progressive, Allstate, State Ranch, Travelers, the Hartford, Safeco and GMAC (suvs).

" If you're texting or chatting while driving, they're mosting likely to think it's fine," says Smith (trucks). "Your rule ought to be 'Do as I state and also as a I do.'" The average cost of including a teenager vehicle driver to your auto insurance coverage can vary from $1,800 to $2,300 annual relying on a few variables and which insurance policy supplier you have.

It is a good idea to compare several insurance coverage quotes when including your teen chauffeur to your policy to get the very best cost. You can anticipate your car insurance coverage costs to raise as much as 82% when including a teenager motorist. This will be identified by your insurance coverage firms average rates, the sex and age of your young adult, as well as what state you stay in.

Something failed. Wait a moment and also try once more Attempt once more.

Top Guidelines Of What Age Does Car Insurance Go Down? - Policygenius

The expense of cars and truck insurance can typically end up being a worry for 19-year-olds. It's a vicious fact that automobile insurance often tends to be more pricey throughout these early grown-up years where you're most likely to be struggling to make a lot of cash.

It's the insurance providers' method to shield themselves versus this added threat.

5 litre engine Ordinary insurance policy expense for a 19-year-old by location, There are many elements that will certainly impact the price of a 19-year-old's automobile insurance coverage costs, and your place is one more considerable one. To reveal the prospective effect of your home address, below are some average quotes for a 19-year-old living in 3 different places. dui.

2 S 5d. 1134 (Truro, TR8) 1481 (Chester, CH1) 1746 (London, E10) These prices are based upon the ordinary expense of cover for automobiles in the locations revealed. Our research study recommends E10 is just one of one of the most pricey places, CH1 stands for an ordinary price area and TR8 represents one of the least expensive areas.

auto insurance laws suvs car insured

auto insurance laws suvs car insured

If a cars and truck is greater than 3 years of ages, you'll have to pay for an MOT test yearly. This examination is to inspect that the cars and truck fulfills the lawful criteria for safety and security as well as ecological friendliness. As the cars and truck obtains older, you'll inevitably have to pay for the price of repair work and maintenance.

The Basic Principles Of How Much Does Auto Insurance Cost For A 19-year-old In Ny?

You can make an insurance coverage case if you want your insurance company to cover the expense of fixings. Nonetheless, as this will certainly impact your no-claims perk, you may favor to cover the expenses of cheaper repair services from your own pocket (vehicle insurance). How to get less expensive cars and truck insurance policy at 19 years of ages Scroll up to see our checklist of most affordable automobiles to guarantee.

This course educates innovative abilities not educated throughout driving lessons, such as driving at evening or on the freeway. Many insurance providers use a price cut to drivers with a 'Pass Plus' certification. A telematics box tracks your driving task and also pass the details on your insurer, so they can validate you're a safe vehicle driver. vehicle.

Concur to contribute even more to the price of a claim, and your insurance company will usually reduce your premium. If you can make your auto much safer, most insurance firms will certainly more than happy to lower your premium. Alterations such as a looter or a costly stereo can send your premium increasing. These products are pricey, and your insurance company will consider the expense of replacing them when calculting your premium.

According to, young male chauffeurs are nearly triple the price of young women chauffeurs, that are on average 2,902 fatalities contrasted to 1,024. Resource URL Insurify performed a study of hundreds of thousands of quotes for adolescent motorists to identify the typical month-to-month expense of vehicle insurance, and they discovered that the prices were greater than the average for all other United state

Unknown Facts About How Much Will It Cost To Add My 19-year-old Daughter To ... - Jerry

insurance cheap car insurance accident insurance company

insurance cheap car insurance accident insurance company

The typical expense climbed 60% for ladies age 19 vs. Resource link The ordinary complete coverage auto insurance price for a 20-year-old man is about $3,600. A plan that meets the state minimum demands to drive prices regarding $1,220 (dui). Source link Expense for All 19 years-olds If you're a 19-year-old, you pay high prices for automobile insurance coverage.

The ordinary cost of full insurance coverage for a 19-year-old driver is $3,560, which is greater than $1,800 greater than the nationwide average for motorists age 30. This results from the truth that they are inexperienced as well as have a high price of mishaps (vans). Resource link, Source link Why is Cars And Truck Insurance Policy So Pricey for 19-year-olds? Automobile insurance rates vary depending on a number of market details.

The other variables that frequently influence premiums are: Marriage status, Location, Sex, Credit history score, Driving background, Automobile make and design Insurance coverage for a 19-year-old is normally expensive, not just due to the fact that of the motorist's age but other variables that likely use to young adults. auto. Youthful drivers usually have short driving backgrounds and low credit report.

Resource link Typical Price for 19-year-olds vs 16-year-olds A 19-year-old will certainly pay about $2,500 less for auto insurance than a 16-year old will. Source URL Average Price for 19-year-olds vs 18-year-olds Car insurance coverage for 19-year-olds is more expensive than it is for the typical motorist, however is much less than that of 18-year-old chauffeurs by themselves policy.

Excitement About Average Car Insurance Costs For 19-year-olds - Valuepenguin

Most Pricey and also Least Expensive States The for 19-year-old drivers is, with an average cost of $1,490 annually for full coverage and $550 annually for minimal coverage - laws.

Both New York as well as New Jacket are no-fault states, and while New Jacket has the highest populace density in the nation, New York chauffeurs usually drop victim to insurance fraudulence. All of these aspects can add to greater insurance policy prices in general for these states. Source link However, these are the five most affordable states for 19-year-old automobile insurance coverage.

Made up of islands, it is not as navigable as other states. Other states like Iowa as well as Maine are a lot more largely booming states with fewer without insurance vehicle drivers when traveling to drive up auto insurance policy premiums. Resource link Cars And Truck Insurance Policy Discounts for a 19-year-old Motorist As a 19-year-old chauffeur, you might get approved for loads of insurance coverage discount rates.

You can save up to 9% off your auto insurance coverage prices. This offers you a typical cost savings of $335. Resource link, Source URL Join Your Moms and dad's Plan to Save If you have a teen vehicle driver that copes with you yet has an inadequate driving record, it's typically less costly for the teenager to be on the moms and dad's plan as well as make use of discount rates that drip to the teenager.

trucks cheapest car dui low cost

trucks cheapest car dui low cost

? The university student premiums detailed below are approximately man and women rates with their very own policy. Rates decrease swiftly within this vehicle insurance policy age brace; between the ages of 18 and 22, students can expect their premiums to be halved if they preserve a good driving record.

Trick Insights Teenager cars and truck insurance coverage is just one of one of the most expensive insurance coverage plans in every state of our nation (car insurance). Adding a teenager motorist can enhance your plan costs to a massive quantity. There are a great deal of various aspects that influence the expense of car insurance coverage for teen drivers and also this is why the amount of car insurance coverage can vary from one person to another.

Teen motorists Check over here are not needed to get complete insurance coverage yet are advised for much better coverage limits. This blog is your in-depth guide, make certain to check out till the end and also bookmark it to refer to later. Our goal with this blog is to supply you with all the information you need to understand about acquiring auto insurance policy for an adolescent chauffeur - perks.

https://www.youtube.com/embed/j-QnFS6A45k

Price, Force recognizes the blog site is a bit much longer but it is worth it. After reading this blog site you don't need to refer to any kind of various other source to recognize extra. We have actually attempted to cover all your doubts and confusion regarding teen automobile insurance prices. Satisfied reading! Why teen chauffeurs obtain higher insurance rates than any kind of other motorist? The very first question that turns up in our head is; why teenage motorists get higher insurance coverage prices? According to the insurance policy companies around the nation; teenager vehicle drivers are much dangerous as compared to various other skilled drivers (cheap insurance).

Some Known Questions About Antique, Vintage, & Classic Car Insurance In Connecticut.

Edit your About page from the Pages tab by clicking the edit button.

Excitement About Classic Car Insurance In Massachusetts

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To Classic & Collector Car Insurance - American Family Insurance

Edit your About page from the Pages tab by clicking the edit button.

The Definitive Guide for Antique Auto Insurance: Do You Really Need It? - The Drive

Edit your About page from the Pages tab by clicking the edit button.

The 10-Second Trick For Classic Car Insurance - Members Home And Auto Insurance

Edit your About page from the Pages tab by clicking the edit button.

The 7-Minute Rule for Classic Car Insurance Quote - Cpc Insurance - Ok

Edit your About page from the Pages tab by clicking the edit button.

An Unbiased View of Should You Switch To Pay-per-mile Insurance? - Bankrate

Edit your About page from the Pages tab by clicking the edit button.

See This Report on Best Pay Per Mile Car Insurance In 2022 • Benzinga

Edit your About page from the Pages tab by clicking the edit button.

An Unbiased View of Should You Switch To Pay-per-mile Car Insurance?

Edit your About page from the Pages tab by clicking the edit button.

The 6-Minute Rule for How Does Pay Per Mile Insurance Work? - Atlanta, Ga

Edit your About page from the Pages tab by clicking the edit button.

3 Easy Facts About Best Pay Per Mile Car Insurance In 2022 • Benzinga Explained

Edit your About page from the Pages tab by clicking the edit button.

8 Easy Facts About What Is Pay-per-mile Insurance? - The Balance Described

Edit your About page from the Pages tab by clicking the edit button.

5 Simple Techniques For My Car Is Worth More Than The Insurance Says It Is, What ...

Edit your About page from the Pages tab by clicking the edit button.

Little Known Facts About Negotiating An Auto Insurance Settlement.

Edit your About page from the Pages tab by clicking the edit button.

The 8-Minute Rule for Tips For Negotiating An Injury Settlement With An Insurance ...

Edit your About page from the Pages tab by clicking the edit button.

Negotiating With An Insurance Adjuster - Bader Scott Injury ... - Truths

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To What To Do Next When Your Car Is Totaled - Time

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of 2022 Ultimate Guide To Ga Automobile Property Damage Claims That Nobody is Talkin

Edit your About page from the Pages tab by clicking the edit button.

Does Insurance Pay Off A Totaled Car? - Fox Business - Questions

If you owe more on the vehicle than what you're used, after that you are in charge of the shortfall, unless you have gap insurance.

Replacement vehicles must be purchased with licensed dealerships. Automobiles that are not more than three years old must be called for. If you turn down a substitute car, the insurance coverage firm have to pay just the quantity it would certainly have or else spent for the replacement vehicle including appropriate taxes, transfer as well as title costs.

The insurance company is allowed to make deductions from the retail value if your auto has old, unrepaired crash problems (insurance affordable). There is no restriction to the amount of the deduction. The insurance coverage firm can additionally make deductions for damage, missing components and rust, however the maximum reduction might not exceed $500.

insured car low cost auto cheap auto insurance vehicle

insured car low cost auto cheap auto insurance vehicle

If your auto has been "totaled" after a mishap, it suggests the expense of Click here for more repairing it is more than the cost to replace it. An automobile can also be considered a complete loss when it's not risk-free to fix, or if it merely can not be gone back to its pre-accident condition.

insurance cheap insurance cheapest auto insurance accident

insurance cheap insurance cheapest auto insurance accident

In many cases they might proclaim it totaled. Even if you handled to drive the cars and truck away from the scene, it can still be completed if the cost of fixings exceeds its worth. Basically: An amounted to cars and truck is an automobile that's remained in a vehicle crash, or otherwise harmed, after which the price of repairs (plus its salvage worth) surpasses its real cash value.

If you have a vehicle loan, allow your loan provider understand that the insurance policy firm will certainly be contacting them. The loan provider will certainly transfer the title into their name, transform it to a salvage title, as well as probably sell the totaled lorry to a salvage lawn (dui). Plan on obtaining a rental auto to drive while shopping for a brand-new automobile.

What Happens If Your Car Is Totaled? - Experian Can Be Fun For Anyone

Amounted to automobiles that their proprietors keep are referred to as "owner-retained salvage." Pertinent state laws can differ below, so consult your cases adjuster before going down this route. If the DMV converts your title into a salvage title it might be tough to get insurance coverage for your cherished vehicle once more after you've gotten it roadworthy.

Your insurance policy company pays the negotiation to the renting business and you get anything left over (or need to comprise the distinction). suvs.

It depends. money. When you inform the other event's insurance policy firm of your claim, you must ask if you are entitled to settlement for a rental cars and truck or various other replacement transportation. While the insurance coverage company have to tell you exactly how much they would enable a rental cars and truck or other transport, they do not have to devote to making any type of repayments up until it comes to be sensibly clear that their insurance holder was lawfully liable for the accident.

Maintain in mind that New Jacket insurance coverage policies require an at-fault driver's insurer to compensate you for the expense of a rental vehicle symmetrical to their liability. For example, if the insurer enables $30 a day to rent a cars and truck and also their insured was located to be 60% to blame, they would just compensate $18 a day to lease a car.

00 daily), the insurance firm has to inform you where you can lease a car for that quantity. An insurance firm is only obligated to compensate you for a rental automobile, or other alternative transport, for the duration of time until the harmed lorry is repaired or, in case of a failure, up until the case is worked out. insured car.

When Is a Vehicle Thought About Totaled? An overall loss car is harmed so severely that it would certainly set you back more to repair than it would certainly be worth. The estimate of repair exceeds the worth of the car. When a vehicle is a failure after a mishap, there is no fixing process - credit score.

How Solving Totaled Car Insurance Problems – Forbes Advisor can Save You Time, Stress, and Money.

You will certainly need to set up for new transport. How Much Will Insurance Coverage Pay for My Amounted To Vehicle? Insurance must pay you the present market worth of the vehicle.

In that case, there need to be no deductible. When the settlement comes from your very own accident coverage and also detailed vehicle insurance coverage, there is possibly mosting likely to be a deductible - auto insurance. Common amounts are $500 or $1,000. The quantity is subtracted from the value of the cars and truck, and afterwards you get settlement from the insurance provider for the continuing to be worth of the vehicle.

Some vehicles are repaired as well as can be driven once more after an examination by a state-certified mechanic. Insurance coverage for a rebuilt salvage car is a lot more restricted than for various other lorries. insurance. That Maintains the Cash From Junking a Totaled Car? Typically, the insurance company keeps the money they make scrapping your lorry.

What Takes place if You Total a Rented Car? Like various other circumstances where a vehicle is amounted to, you obtain the current market worth of the rented lorry as payment, minus any type of insurance deductible that applies. The terms of the lease continue. Generally, the worth of the vehicle is less than what you owe on the lease, but you may need to cover the distinction.

GAP protection might pay the distinction. If you have it, you might not need to pay of pocket if the value of the vehicle is less than what's remaining on the lease. GAP insurance is optional when renting an automobile, however it's a way to protect a vehicle driver from a considerable, unexpected loss.

The auto is considered a salvage car when the expense of returning it to a roadworthy condition is even more than the cash money value of your automobile. An insurance firm might make use of a reduced value to figure out whether to complete the car (suvs).

See This Report about How Does The Insurer Decide If Your Car Is A Total Loss After ...

In addition, if an additional party is at fault for the accident, their insurance policy ought to pay you for your totaled lorry. Our legal representatives function to aid targets get reasonable repayment for their insurance coverage claims.

Having actually gone through two car accident arrangements with the automobile insurance provider within four months of each various other due to two amounted to automobile accidents (neither of which were our mistake), it's obvious that understanding just how to work out the best negotiation for an amounted to car is essential to obtain the best bargain on an amounted to car from your insurance policy coverage. cheaper auto insurance.

A damaged vehicle is declared a "failure" when the estimated cost of making repair work surpasses the real cash money value of the cars and truck. This kind of case is slightly various from other extra minor claims, as well as requires a little bit more effort on the component of the guaranteed. Here's what you require to find out about auto insurance policy claims related to a failure - car insured.

PD is mandatory in every state, but the only way to get a payout from it is to versus another driver's PD. For you to obtain payment from PD, the other driver will additionally need to have actually been. The simplest and most certain means of obtaining settlement for a complete loss is through your very own insurance coverage firm, which you can do through accident insurance coverage (automobile).

Assuming you have these types of insurance coverage in position and also that you are not harmed or active looking for clinical careyour very first action after the damages occurs would be to sue with your insurance provider as you would certainly any A cases insurance adjuster will certainly come to inspect the vehicle to evaluate the damage (insurance company).

If the adjuster determines the price to repair the problems to the car is greater than it deserves to themthat is, then it is taken into consideration an overall loss. What makes up a complete loss is not always basic, and also just how it's determined actually ranges states. affordable. Some states pass a "failure threshold" (TLT), where damage only requires to exceed a certain portion of a vehicle's worth to be identified a total loss.

How Wonder No More: Here's How Much Your Totaled Car Is Worth can Save You Time, Stress, and Money.

If you were to crash a Toyota Camry valued at $4,800 in, at the very least $2,880 (60%) of damages would certify the vehicle as an overall loss. If the accident occurred in, however, there would need to be at least $4,800 well worth of damage to be taken into consideration total loss.

After a complete loss designation, the vehicle is generally taken by your insurance policy company, which after that informs the DMV that the auto has been totaled. Depending upon the state, the automobile will certainly be stated "salvage," as well as any purchasers who concentrate on restoring lorries can acquire the automobile from the company.

Your settlement will be the ACV minus the value of the vehicle as salvage. Amounted to, a salvage cars and truck will still have some worth in its parts and prospective to be brought back.

For example, you may make a situation that they did not totally account for any kind of adjustments you made. You will be needed to send paperwork and any evidence revealing the auto is really worth more than previously established. If you feel you are not sufficiently compensated, you may bring the instance to a lawyer to deal with in your place.

The ACV of the vehicle is identified by its pre-loss market price, much less depreciation from when it was brand-new. Ultimately, the ACV of your auto will be identified by its deterioration, as well as age in addition to other elements your insurer considers relevant. It is very different from the number you would certainly locate on Kelley Blue Publication or Most large insurers have their very own technique of identifying ACV.

/How-is-total-loss-value-calculated-527264-c88380cce1754e25ba9671052e6bd065.gif) affordable auto insurance vehicle cheapest cheapest

affordable auto insurance vehicle cheapest cheapest

If your vehicle is leased or funded, then the compensation returns to the leasing or financing business. If you complete a rented or funded cars and truck, there is a great chance there is a respectable quantity entrusted to pay. While the insurer will pay you for the worth of the car, it is likely the worth has actually decreased, and also does not reflect the worth of the auto, which you took a lease for.

Get This Report on What Is Total Loss After A Car Insurance Claim? - Valuepenguin

Frequently asked concerns What is a failure in automobile insurance? A total loss happens when your vehicle is damaged terribly sufficient in a collision that it would certainly set you back even more to repair the car than it would certainly to change it. A failure additionally applies if your auto is stolen, so long as you have comprehensive coverage. cheapest auto insurance.

An insurance claim adjuster will certainly meet you to examine the damages and determine how much you must be paid. The main difference is that along with choosing a price of repair work, the insurance adjuster needs to likewise develop a worth for your auto. This will identify whether the cars and truck is in fact a total loss, as well as the overall amount you will certainly obtain.

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg) trucks cars insurance affordable accident

trucks cars insurance affordable accident

If you have a new car and also, you'll get enough cash to acquire an entirely brand-new variation of your car. Can I keep the vehicle if it's a failure? Typically, if your car is a complete loss, your car insurance provider will certainly require that you turn your damaged automobile over to the company.

Picture resource: Getty Images New autos can be extremely costly. Automobile insurance coverage is supposed to secure chauffeurs versus out-of-pocket economic losses. As an outcome, if a brand-new automobile is totaled and also can not be fixed, several drivers might presume their insurance firm will pay them payment based on what they spent for the car (insured car).

It does not actually matter exactly how much a new car in fact cost. Possibilities are great that chauffeurs will certainly obtain back much much less than the quantity they paid out.

The issue is, brand-new cars drop or decrease in value very promptly. In fact, in the first year that a driver possesses the auto, the lorry typically sheds around 20% of it's value. Much of that loss takes place as quickly as the vehicle is driven off the lot. The result is that the fair market price of the automobile-- the amount the insurance company pays-- is mosting likely to be much less than the amount the motorist paid to acquire the cars and truck.

What Should I Do If My Car Is A Total Loss? - Alllaw Things To Know Before You Buy

That's because the insurance company will only repay them for the car's dropped value. cheap. And for motorists who paid money for the car yet who are reimbursed a lot less than they paid for it, they won't be able to acquire a similar new automobile.

https://www.youtube.com/embed/krgdoXBttBI

What should drivers do to stay clear of losses? For motorists who intend to make certain they don't get stuck paying the balance of a vehicle loan out of their own pocket-- or driving an older, substandard car after collapsing a new one-- there are a few options. Several insurers use gap insurance policy and, as a matter of fact, many lenders require it.

7 Easy Facts About Car Insurance: Auto Insurance Coverage For May 2022 Shown

New motorists often tend to pay greater car insurance coverage rates, no matter age, due to the fact that insurance coverage firms aspect driving experience right into your quote - money. Sometimes, you can anticipate to pay $5,000 or even more for vehicle insurance policy in your very first year of driving. You can reduce new car insurance coverage by searching for quotes, selecting the best quantity of coverage and searching for discounts.

Driving experience is one of the most essential variable when it concerns setting cars and truck insurance policy rates (cheaper). Experienced motorists will certainly pay much less than brand-new drivers since insurance provider consider them lower threats for entering a crash or filing a claim. Just how much extra new motorists will certainly pay for cars and truck insurance policy Usually, newbie chauffeurs pay concerning $4,529 annually for cars and truck insurance, whereas experienced chauffeurs are only paying $1,427 annually.

These auto insurance rates are for a 35-year-old The golden state resident and also show the difference in expense in between a new chauffeur and a skilled vehicle driver. The insurance policy prices estimate for new vehicle drivers are significantly greater. Geico is the most expensive, billing our example motorist with no experience $6,339 per year.

Exactly how to obtain cars and truck insurance for the initial time When buying cars and truck insurance policy for the initial time, you will certainly need to: Gather individual as well as car information - insurance affordable. Obtain or work with an insurance representative.

Having the year, make as well as design of your cars and truck all set is also essential, as it will certainly help you get the very best as well as most exact plan for your brand-new vehicle insurance coverage - trucks. Just how newbie motorists can find economical car insurance policy Drivers can discover inexpensive cars and truck insurance if they: Look around and also contrast insurance coverage rates.

Florida Insurance Requirements Things To Know Before You Buy

Boost elements that might influence insurance prices, such as credit ratings. Shop around and compare insurance policy rates You need to get numerous quotes from multiple cars and truck insurance coverage business to identify which firm will use you the cheapest insurance policy quotes for new vehicle drivers.

Different companies use various factors when determining your prices, and several of the much more well-known insurer might not necessarily offer the cheapest feasible rate. insurers. Get the appropriate quantity of protection If you get more auto insurance coverage than you require, you'll be paying additional for protection you'll never ever use.

Or else, you're paying of pocket for unnecessary expenses. Boost factors that impact insurance coverage rates for new drivers Many aspects affect auto insurance coverage rates for newbie motorists. Some of them can't be controlled, such as age as well as area. There are crucial factors, such as credit score scores, that chauffeurs can take steps to boost over the long term and also obtain reduced insurance coverage prices.

These rates were publicly sourced from insurer filings and need to be utilized for relative purposes just your own quotes may be different.

While there are a couple of ways to obtain vehicle insurance policy, the ideal and most efficient means to get covered is by comparing quotes from multiple business online. By doing this you can rapidly find the most inexpensive rates in your location for the coverage you need. We don't offer your information to 3rd parties.

Not known Facts About What Is Auto Insurance? - Iii

Then: How to acquire auto insurance policy in 5 steps Find out just how much automobile insurance coverage you require, Fill up out an application, Contrast automobile insurance coverage quotes, Pick an auto insurance provider as well as obtain guaranteed, Terminate your old cars and truck insurance coverage 1. Identify just how much auto insurance coverage you require, Figuring out how much insurance coverage you need is one of the most vital parts of purchasing auto insurance policy.

As you buy insurance coverage, make sure to look very carefully at whether there are any type of attachments you can remove. We don't sell your info to 3rd parties. 3. Compare automobile insurance policy quotes, It's a good suggestion to get quotes from a couple of various insurer prior to you select a plan.

You ought to seek the insurance business that uses you one of the most security and the finest client service at the lowest prices. Uncertain which business to select? Use our compare auto insurance policy web page or our checklist of the finest car insurer to find out more about your alternatives before you select a plan.

What are the different methods to go shopping for auto insurance policy? Depending on your choice, you could buy a plan directly from an insurance coverage business, work with a representative, or obtain cars and truck insurance policy from a broker.

When you get an automobile insurance plan, you'll set a start day for when your plan will begin, and also you'll pay your first costs - cheap. You'll typically receive evidence of coverage and some type of welcome package from your insurance provider, with details about how to access your account and also where to see your ID cards or statements page.

Top Guidelines Of Ten Tips For Buying Auto Insurance

Terminate your old cars and truck insurance coverage policy, If you have actually been going shopping for vehicle insurance coverage to change a present policy, wait until Look at this website after your new protection is in place before you cancel your old policy. vans. You intend to make certain you don't leave any spaces in your insurance coverage. To do this, established the termination day of your old plan and also the effective day of your brand-new policy on the same day.

Just how do I restore my auto insurance plan? Many vehicle insurance coverage automatically renew at the end of the policy term. You'll be informed by mail or email if your plan is readied to restore, as well as you might be motivated to verify that your info is all the same before renewing your plan.

Can you obtain car insurance policy immediately? Yes, you can get automobile insurance promptly with most insurer. After you've contrasted rates on-line as well as are ready to acquire protection, establish your policy's begin day as the day that you're shopping. Your policy will enter into effect as soon as possible.

, however the type and cost of that insurance coverage can differ dramatically. Daily, consumers are discovering that there are alternatives readily available to make it simpler to conform with the legislation. The Car Insurance Cost Reduction Act mandated that a be readily available to all motorists. It is very important to understand that you are breaking the legislation if you drive uninsured.

cheaper cheaper car insurance insure vehicle insurance

cheaper cheaper car insurance insure vehicle insurance

In the future, your vehicle might be seized if you are captured behind the wheel without protection - vehicle insurance. Below we will examine the. The Standard Policy uses much less security, but at a lower expense than the.

All About State Auto Insurance

low-cost auto insurance auto insurance automobile cheaper car insurance

low-cost auto insurance auto insurance automobile cheaper car insurance

Particular plan coverages are optional by the insured. Fundamental individual automobile insurance policy is mandated by most united state states and also laws differ. In North Carolina, liability protection is required, together with uninsured driver insurance coverage. Policies are typically issued for six-month or 1 year period and also can be renewable. If you have inquiries, the Consumer Solutions Department of the Division of Insurance is right here to aid.

Just since your state calls for a minimum quantity of insurance coverage does not mean that's specifically what you need to buy. Actually, many motorists buy even more coverage than their state requires to make sure that they are covered for a variety of problems-- not merely a fender bender. In order to better identify your auto insurance needs, consider these five guidelines: Know Your State Laws, Bear in mind that forty-seven states require that you acquire obligation insurance.

low cost insurers vehicle insurance business insurance

low cost insurers vehicle insurance business insurance

Do you desire coverage for a rental vehicle if your automobile is harmed? Do you desire an extensive service warranty to spend for parts and also labor if your vehicle breaks down? If your automobile is rented, you will possibly need gap insurance which spends for the difference in between what your insurance provider pays and also what you owe on your lease if the automobile is entirely amounted to - insurance companies.

The initial item of the plan is usually obligation insurance coverage. If you just have minimum obligation protection as well as you wound somebody, their lawyer can go after your personal possessions. You need to understand your properties and also what you can afford to shed in the event of a crash.

If you do obtain right into an accident, it is much far better for the insurance policy company to be accountable than for you to be personally liable. Remember to run with various scenarios such as if I amounted to somebody else's auto, will my insurance cover it?

California Car Insurance - Get A Quote - Liberty Mutual Can Be Fun For Everyone

business insurance vans insurance affordable cheaper auto insurance

business insurance vans insurance affordable cheaper auto insurance

Automobile insurance policy is just regarding just how much you want to pay of your own pocket versus just how much you want the insurance coverage business to cover. When you determine this, you're ready to buy your car insurance coverage policy.

automobile vehicle credit car insured

automobile vehicle credit car insured

If someone obtains your car, are they covered under your car insurance policy? The other motorist will commonly be covered by responsibility insurance, you'll have your own protection, and also that's all you'll require to recognize.

Many of these disagreements revolve around whether the chauffeur or automobile in the accident suits any of the certain groups that may be included or left out from a responsibility plan. Below is a fast overview to typical inclusions and exclusions. (Find out more concerning various sorts of vehicle insurance protection.) What Drivers Are Covered? The named insured is the person or people called in the plan.

Also if a partner of the called insured is not named on a plan, vehicle obligation insurance usually covers the partner too, while driving any automobile. If the pair no longer cohabit, nevertheless, the plan will certainly not cover accidents triggered by a spouse not named on the policy unless that partner was driving the covered automobile with the permission of the called partner. low cost.

Any type of individual who is making use of, with approval, an automobile especially called in the plan is covered (insurance affordable). So, a person that swipes the vehicle is not covered due to the fact that the burglar was not using it with authorization. The permission question additionally comes up if, as an example, a young adult allows an additional teen drive a vehicle without the parent owner's approval.

The 5-Minute Rule for State Auto Insurance

https://www.youtube.com/embed/aFLb6WaIbNQAny cars and truck, energy car (see listed below), or other vehicle with which the named insured changes the initial named automobile, and any kind of extra vehicle the called insured has during the policy duration, is also covered. Some policies, however, cover replacement or extra lorries just if the guaranteed person alerts the business of the brand-new or various vehicle within thirty days after it is obtained (cheaper auto insurance).

How Much Does It Cost To Add A Teen To Your Car Insurance ... for Dummies

It is necessary to shop around to find the best rate for you and go shopping every 6 months as your teen gets older as well as conditions change. Sex additionally impacts insurance coverage premiums. Statistically, a 16-year old male vehicle driver is most likely to receive a citation or enter an accident than a 16-year old women vehicle driver.

Higher-end vehicles are extra pricey to guarantee as a result of the price to fix them (cheap insurance). Why Are Teen Car Insurance Policy Fees Greater? All insurance provider base their rates on the amount of threat entailed (cheaper car insurance). When determining the costs amount, they take right into factor to consider the insured's driving experience, where they live, where they drive, exactly how much they drive to work or institution, the kind of vehicle, as well as their case background.

Vehicle drivers that are 16 and 17 obtain in approximately double the number of fatal crashes as older teenagers. vehicle. The elements that contribute to the boost in fatal crashes according to the Center for Disease Control consist of: A low portion of teens wear their seat belts. credit. Teens are more probable to speed.

liability car insurance cheap auto insurance insurance company

liability car insurance cheap auto insurance insurance company

/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png) insurers affordable auto insurance affordable auto insurance automobile

insurers affordable auto insurance affordable auto insurance automobile

What Does Vehicle Insurance Coverage for 16-Year-Old Ladies and also Males Price? Insurance for a 16-year-old, no matter their sex, is costly.

Costs can be up to 50 percent lower for a 16-year old man driver who is under their parent's plan in contrast to getting their own cars and truck insurance. liability. Keep teenagers on the household plan. Research study reveals that it can set you back up to an additional $1,700 every six-months to have a separate policy.

Average Car Insurance Cost In Ontario - Surex Fundamentals Explained

Establishing gas mileage criteria or limit them to driving to as well as from college and also work, No passengers in the automobile under a specific age While your 16-year-old may be accountable behind the wheel, statistics show that the bulk of major automotive occurrences are caused by young vehicle drivers.

laws suvs perks prices

laws suvs perks prices

When going shopping around for the very best rates, keep cost-savings strategies in mind, and also be certain to speak to your young vehicle driver concerning the relevance of being liable when driving. Information and also study in this post verified by ASE-certified Master Technician of. For any comments or modification requests please call us at.

You might have the ability to discover even more info regarding this and comparable content at piano - cheapest. io. cars.

Guaranteeing a 16-year-old motorist can be costly. Considering that teen vehicle drivers don't have the advantage of experience for insurer to think about when establishing rates, they are considered riskier to insure. auto. There are techniques you can utilize to conserve money and obtain the most effective vehicle insurance for a 16-year-old motorist.

There is one area where parents can score substantial financial savings: Selecting to add a 16-year-old to a family members strategy, which is generally cheaper, as opposed to having the teen get an individual plan. Guaranteeing a 16-year-old on a specific policy features an average increased price of $1,947 each year.

Not known Incorrect Statements About Children - Washington State Health Care Authority

Least Expensive Auto Insurance Coverage for 16-Year-Old Males as well as Women, There is a difference when it pertains to gender for guaranteeing new teenager drivers. Typically, it sets you back even more to insure a 16-year-old man vehicle driver than a women driver of the exact same age. cheap insurance. That's due to the fact that male motorists have a higher crash price and even more insurance coverage claims and are as a result more of a risk to insurance provider.

Scroll for more Compare Insurance Policy Rates, Guarantee you are getting the most effective price for your insurance. insurance. Contrast quotes from the top insurer - affordable. While the most affordable ordinary price we found for including a 16-year-old to a family members policy is $3,146, it sets you back an average of $5,318 for a specific plan for the same-age vehicle driver.

Scroll for even more Vehicle Option Matters When Guaranteeing a Young Vehicle driver, The type of car a teenager motorist utilizes is one more considerable consider just how much it will set you back to add the teenager to your plan. Pricey and high-performance vehicles, as an example, will certainly drive up rates. On the other hand, a more economical, safer automobile can be a reliable price cutter. affordable.

Contrast Quotes for the Ideal Policy for Your Family, Screen Your Teen Driver to Make Sure a Clean Driving Document, Just like motorists of any kind of age, guaranteeing your young vehicle driver maintains a tidy driving document is a terrific means to keep cars and truck insurance policy expenses down (cheaper). On the other hand, crashes and also tickets will drastically increase automobile insurance policy costs for your 16-year-old.

Reduced the Coverage Quantity, The amount of protection you require will vary, however, for those who agree, decreasing those can lower the price of insurer (insured car). You'll still have to stick to your state's minimum requirements, certainly, but reducing the coverages can be a legitimate alternative for those seeking to save.

The smart Trick of Cheap Car Insurance For A 17-year-old - Mycarinsurance123 That Nobody is Talking About

It's additionally vital to be aware that by selecting this sort of insurance coverage, you won't be covered for your own automotive damage or individual injury prices. In the event of a collision, that might develop into a pricey issue if you don't have money handy to replace or fix a ravaged auto - business insurance.

Something like a Camry a four-door car that made the top-safety choice from the Insurance Policy Institute for Highway Safety and security will certainly be a less expensive choice to insure than a muscle mass automobile that concentrates on efficiency, like a Mustang - automobile. Sports autos and expensive deluxe vehicles, generally, will certainly be much more expensive, too.

/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png) vehicle insurance auto insurance car insurance insurers

vehicle insurance auto insurance car insurance insurers

https://www.youtube.com/embed/jIsZk625Chw

Website Traffic Statistics for 16-Year-Old Drivers, The more youthful the vehicle driver, the most likely it is that they'll be associated with a crash. affordable car insurance. According to data for police-reported accidents in 2014 to 2015, drivers aged 1617 were associated with nearly double the variety of fatal collisions than Find more info 18- as well as 19-year-olds for each 100 million miles driven.

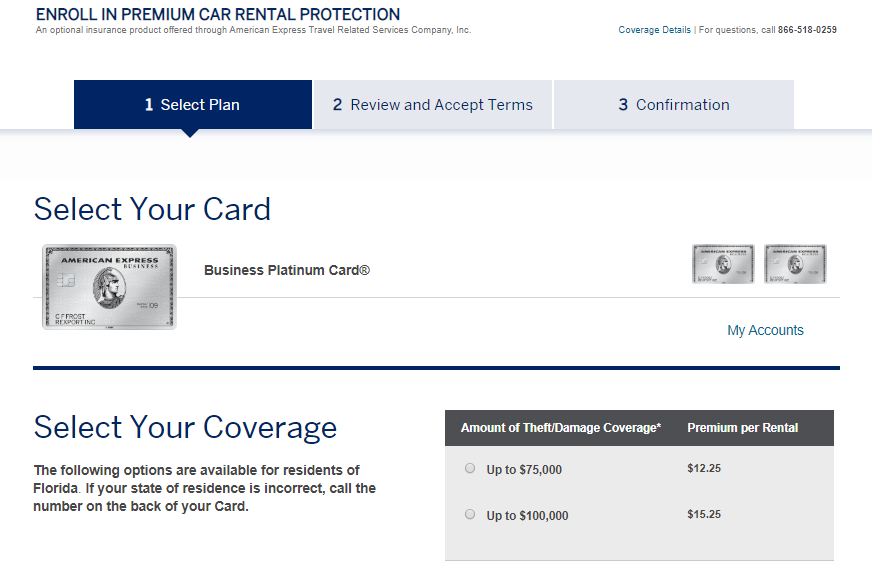

Top Guidelines Of These Credit Cards Offer Car Rental Insurance Benefits

Mobile phone Security, Your card may also include mobile phone security against burglary or damages when you use it to pay your mobile phone expense (with a lot of stipulations, obviously). Benefit From Added Security, Auto rental insurance coverage is one of the lots of valuable advantages take a trip incentives charge card can offer - insurance company.

Marketer Disclosure Most of the bank card uses that appear on the internet site are from charge card companies from which obtains payment. This payment might influence just how and where items appear on this site (consisting of, for instance, the order in which they show up) (car). This website does not consist of all charge card companies or all available charge card deals.

vehicle vehicle cheaper automobile

vehicle vehicle cheaper automobile

Content Note: Point of views expressed here are the author's alone, not those of any type of bank, charge card provider, airline companies or resort chain, and have not been examined, approved or otherwise backed by any one of these entities. risks.

It's the tough sell at the car rental counter that every person recognizes is coming yet few know how to handle: rental auto insurance coverage. You might recall that your charge card provides some kind of cost-free protection for rental autos. That's possibly true, which protection can be beneficial. (Dive ahead to our listing of cards with primary protection.)Yet you have to understand what insurance coverage you have and also when it puts on your service. vehicle insurance."Customers can typically be puzzled about what their bank card does and also does not cover," claims Loretta Worters, spokesperson for the Insurance policy Info Institute.

Not known Incorrect Statements About Auto Rental Collision Damage Waiver

The rental vehicle business has insurance coverage on the cars and truck. What they cost the counter is a waiver that claims the rental firm (as well as its insurer) won't come after you monetarily if the automobile is damaged or swiped. Lots of individuals can decline rental car security because it replicates coverage they already have, typically because their own auto insurance coverage policy applies.

cheap insurance prices credit score money

The protection that a lot of bank card provide, normally for damages to or burglary of the rental automobile, starts after your individual auto insurance coverage pays. That supposed secondary coverage can be valuable. Maybe essential, it can repay you for your vehicle insurance policy deductible, which might be as high as $1,000 (cheapest car insurance).

(Jump ahead to our listing of cards with key protection.)Where to try to find details, A lot of the significant bank card networks, consisting of Visa, Mastercard and American Express all provide some type of rental car insurance coverage for cards on their networks. Nevertheless, the coverage on any kind of certain card can vary according to the financial institution that provided it, and also cards from the exact same issuer can have various degrees of insurance coverage. low cost.

If you can safely decline $20 daily of add-ons at the rental counter since of your bank card, that saves you $280 on a rental throughout a two-week vacation (suvs). What to ask your debt card issuer, Whether you're calling your issuer on the phone or browsing your advantages guide, these are the inquiries you'll want addressed (insured car).

The Only Guide for Credit Card Benefits Guide - Usaa